The Inclusion Paradox: Why Banking the Poor Isn’t Lifting Nigeria Out of Poverty

The lack of real world impact has turned "banking the unbanked" into a meme. But there's two sides to this story

Nigeria’s financial inclusion journey is a tale of two realities.

The first reality is headline-worthy.

From 2016 - 2022, Nigeria became Africa’s hottest fintech market, with over $2.7 billion flowing into fintech startups. Today, the country boasts five unicorns, three of which—Flutterwave, OPay, and Interswitch—are fintechs and have expanded beyond Nigeria’s borders, cementing the country’s reputation as a tech powerhouse (pdf).

This has paid off. In those same years, more than 15 million new bank accounts were opened. On the surface, this looks like a success story - more funding, more fintechs, more people with access to financial services. It’s everything you would expect from financial inclusion, right?

But when we put boots on the ground to examine the impact of these investments on citizens, the second reality emerges.

In 2018, Nigeria became the poverty capital of the world, with 87 million people living on less than $1.90 a day. Today, that number has grown. The World Bank reports that Nigeria’s poverty rate has risen from 40% in 2018 to 46%, with the number of people living in poverty at 104 million.

There's more bad news. The Multidimensional Poverty Index (MPI), which measures poverty beyond basic income, revealed that 133 million Nigerians are multi-dimensionally poor. This means they earn barely any money, and also lack good education, healthcare, and humane living standards.

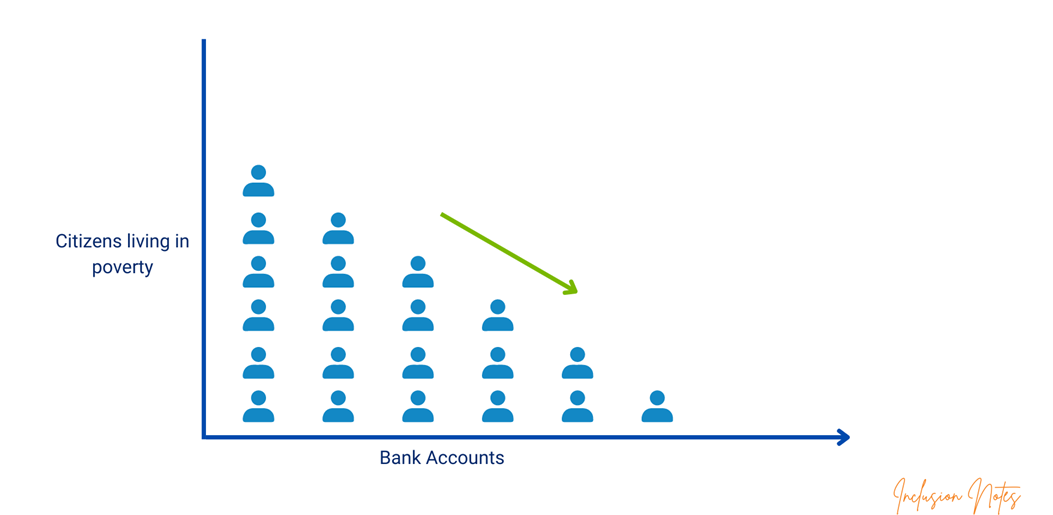

And there's the paradox: as the number of bank accounts has risen, so has poverty.

This raises an uncomfortable question: Isn't financial inclusion supposed to alleviate poverty?

So what exactly is going on?

First off, let's clear the air. Financial inclusion is more than having a bank account.

True financial inclusion means integrating financial services into people's lives in ways that improve their financial health, help them manage financial emergencies, and create more opportunities.

It's a nuanced definition, away from the simplistic “inclusion = bank account”.

But somewhere along the way, financial access (essentially, counting bank accounts) became synonymous with financial inclusion. This wasn’t by design; it was a matter of necessity.

How?

Let’s start with the Central Bank of Nigeria. The former governor prioritized financial inclusion, making it one of the administration’s key objectives. The target? 80% inclusion by 2020. When that didn’t happen, it shifted to 95% by 2024—a target we’re far from meeting. With a need to show progress year-on-year, the Central Bank focused heavily on the most measurable aspect: bank accounts.

This made sense. It was a straightforward metric that could be tracked and showcased, even if it wasn’t telling the whole story.

Next, look at the startup ecosystem. With the Central Bank focusing on account numbers, fintech entrepreneurs saw an opportunity. Venture capitalists, hoping to catch lightning in a bottle at the ground floor, came hunting for the next M-Pesa. Millions of Nigerians are outside the banking system, and whoever could bring them in would reap the financial spoils.

But there was a catch. For the funding to keep flowing, these entrepreneurs needed to show traction — and the easiest result to show was how many bank accounts they opened. It’s scalable, trackable, and easy to sell to investors.

And so over time, the narrative shifted. It became about numbers, not impact—bank accounts opened, not lives transformed.

Finally, there’s the media. When you’re advocating a nuanced subject like financial inclusion, it’s easy for the key messages to get lost. Media doesn’t handle nuance well. And so, instead of diving into the complexities of what true inclusion looks like, the focus zeroed in on the most straightforward narrative: the growing number of bank accounts and the race to meet the CBN's targets. The bi-annual Access to Finance survey by EFinA became the definitive measure of progress.

This abridged history lesson is crucial to understanding how we got here.

The Central Bank, entrepreneurs, and the media—three key players—have, perhaps unintentionally, brewed the perfect storm.

In the process, the real narrative and purpose behind financial inclusion got lost.

This is not diminishing the pivotal roles each of these players had in the growth of Nigeria’s financial ecosystem. Today, the number of Nigerians with bank accounts is at an all-time high. That is impressive.

But that narrative has had its time in the sun.

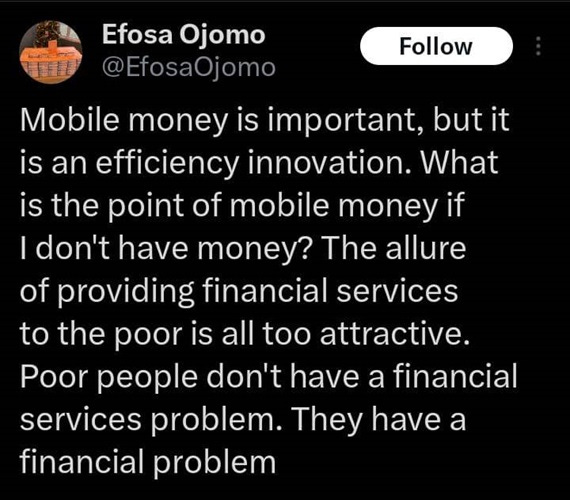

Poverty will not be solved by bank accounts alone. Many people open accounts, but they don’t necessarily keep using them.

Over the last few years, we’ve built infrastructure that has transformed Nigeria’s economy. Just imagine—if the fintech boom hadn’t occurred, how bad would Nigeria’s economy be today? How would the COVID-19 crisis have played out?

This same infrastructure has the potential to uplift millions more.

This is the next chapter in Nigeria’s financial inclusion journey, where the goal isn’t just getting people into the system.

Now, the focus should be empowering them.

Insightful as always. Thank you, Ibukun.

I love the depth of insight in this article. Your ability to highlight the growing disparity between the increasing number of bank accounts and the persistent rise in poverty is both thought-provoking and timely. It’s a critical issue that demands attention, and you’ve captured it with clarity.

However, I was hoping the article would delve deeper into the essence of financial inclusion. Specifically, an exploration of what true financial inclusion entails and what its practical outcomes should be for the average Nigerian would have been invaluable. While you adeptly explained the paradox, a further discussion on the ideal financial ecosystem we should strive for, and how access could evolve into tangible financial empowerment, would have been a powerful addition.

In any case, your piece opens the door to an important conversation. I believe that expanding on this next step — what financial inclusion should achieve in real terms — would provide readers with not just a reflection on the problem, but a clearer sense of the path forward. Thank you for sparking this dialogue, and I look forward to your continued contributions on this vital subject.